Don’t leave your unemployment benefits on the table

Who can collect unemployment?

Eligibility to collect unemployment payments varies depending on the state you live in, but there are three basic criteria:

You must be available to work.

You must have earned money through a job during a specific time period. (The funds available to pay you come from a tax paid by previous employers.)

You must be out of work involuntarily.

Yet many people fail to apply, believing in error that they aren’t eligible.

Apply for unemployment, even if you’re “fired.”

Being dismissed from your job doesn’t prevent you from collecting unemployment. In every U.S. state except Montana, employment is “at-will.” Unless you and your employer have signed a contract that states the length of your employment, you can quit anytime and the employer can let you go for any reason or no reason at all, unless the reason is against the law, like discrimination or retaliation.

It doesn’t matter whether your employer lets you go because they don’t have enough work for you, is unsatisfied with your performance, or just doesn’t like you: It’s usually worth submitting a claim to your state unemployment office.

When an employer lets a lot of people go at once, this is often called a “layoff,” “reduction-in-force” (RIF), “downsizing,” or “rightsizing.” In some cases, like in the recent pandemic, a company might furlough employees, dismiss them temporarily with the intention to hire them back.

You cannot collect unemployment if you quit your job or if you are fired for certain serious types of misconduct at work. After you apply, your employer may claim you aren’t eligible. If that happens, you can appeal the decision in front of an administrative judge.

Time your unemployment application

You can file your application – online, over the phone, or in-person – the first day you are out of work. If you wait, your payments won’t be retroactive. Depending on your state, there may be a waiting period between the time you file your claim and the first week for which you’ll be paid.

The amount you’ll receive is based on your earnings; it’s funded by a tax your employers pay. Keep in mind that this baseline isn’t necessarily set by the wage of the job you’re let go from, but on your earnings from a window of time that can be several months back.

Here’s how that may affect you: Say, for example, you picked up some extra hours at a seasonal job for a few weeks in December and lost your main job in March. Depending on the cutoff date for calculating your benefits, you might want to hold off on applying for benefits so that your higher-earning December income will be used to set your weekly check amount.

Keep job search records to share with the unemployment office

Unemployment benefits are intended to tide you over while you look for new work. Many states require that you make consistent efforts to find a new employer. You need to certify (weekly or biweekly) that you are still unemployed, and list the places you’ve applied.

Keep a journal of applications submitted online, resumes mailed out or delivered in person, and phone calls you’ve made to employers. This is also a good practice to help organize yourself and gain insight about your progress, such as whether your resume is effective in garnering interviews.

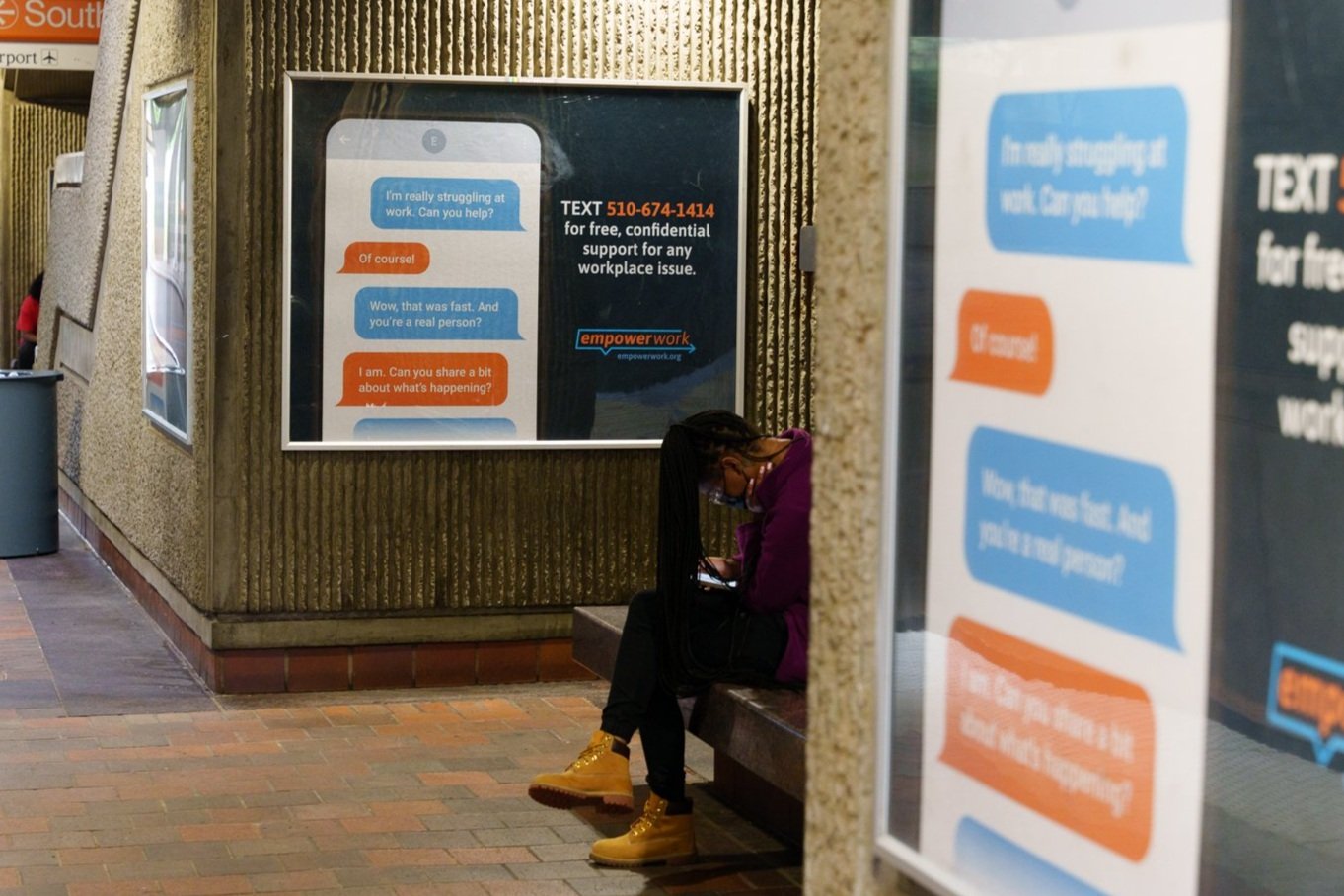

*Note: Empower Work provides non-legal support for workplace challenges. This information, while authoritative, is not legal advice or guaranteed for legality. Employment laws and regulations vary by state. We recommend consulting with state resources for specific interpretation and decisions. If you believe you were discriminated against in violation of the law, we recommend you seek legal advice.